It is natural to have many questions and worries when faced with a legal issue or litigation. The experienced lawyers at DeLoach, Hofstra & Cavonis, P.A., ask many common legal questions and provide useful answers to help get you in making the best decisions for you and your family.

- Page 6

-

How Can I Stop My Loved One From Writing Checks?

-

What should I say to an insurance adjuster after an accident?

-

If I have a good estate plan, can I avoid a guardianship proceeding altogether?

-

How Is the Probate Estate Closed?

-

What Will I Need to Start the Probate Process?

-

How Do I Find The Right Probate Attorney?

-

Will my case go to trial?

-

What does it mean when an attorney is “board certified?"

-

How long do I have to file a wrongful death lawsuit in Florida?

-

What should I do if I was hit by a car while riding a bicycle?

-

Should I file an accident report if I'm hurt in a store?

-

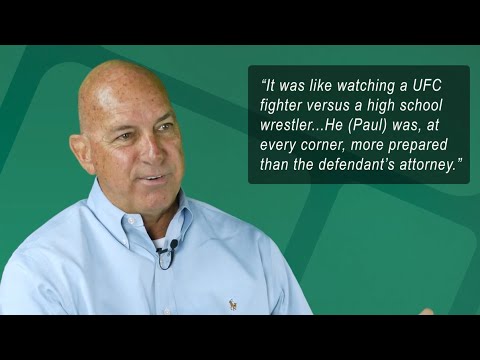

Why is it important to hire an injury attorney who's willing to go to trial?